AS FEATURED IN:

Thoughtful, Comprehensive, Estate Planning Attorneys

Estate planning is a process that everyone should go through, regardless of age or assets. Our estate planning attorneys can help you create a customized solution that can be made up of a living trust, will, healthcare directives, and guardianship for minors. This process is important because it helps to protect your assets and ensure that your wishes are carried out in the event of your passing. We understand that estate planning can be a complex process, but working with our experienced attorneys can make it much easier. At our firm, we take a comprehensive and customized approach to estate planning. We'll work with you to identify your goals and create a plan that fits your needs. We'll also make sure that all your questions are answered and that all loose ends are taken care of. Contact us today to learn more about how we can help you plan for your future.

A trust isn’t just for high-value estates. A trust saves the expense of probate, provides a higher level of privacy, and allows for incapacity planning.

Whether you want to transfer property into your trust, arrange for a transfer-on-death, or discuss business ownership of property, we can take care of all real estate transfers associated with your estate plan.

Make sure your children are cared for by people you choose, not someone appointed by the court. We help you think through whether different people may be needed for guardianship of the estate and of the person.

Protect your legacy by thinking through and planning for succession now, so your business interests are handled properly.

Many people appointed as trustees or personal representatives are family members with great respect for your wishes and invaluable knowledge of family dynamics. We help them through the administrative aspects and make sure they meet all legal requirements of administering trusts or estates.

A will is an important component of any estate plan, but it’s often not the only planning tool. We evaluate your goals and help you create the best estate plan for your situation.

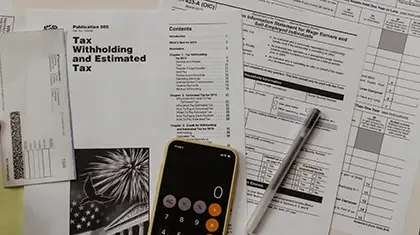

Spelling out where your assets go after your death is just one piece of the puzzle for many people during the estate planning process. We help you plan in a way that minimizes tax liability, so more of your money goes to your beneficiaries.

Have you recently moved to California, had a change in assets, or want to change your beneficiaries? Or if it’s simply been a while since your estate plan was created, you could benefit from an estate plan review. A thorough review is a good opportunity to make sure your plan is in line with current tax laws and to make sure all assets are included.

Our Flat-Rate Plans

Includes:

Trust

- Will

- Guardianship of Minors

- Durable Power of Attorney

- Advanced Healthcare Directive

- Property Assignment & Memorandum

- Transfer of Primary Residence

| Flat-Rate: $2500

Includes:

Joint Trust

- Marital Trust Planning

- Will

- Guardianship of Minors

- Durable Power of Attorney

- Advanced Healthcare Directive

- Property Assignment & Memorandum

- Transfer of Primary Residence

- Special Planning Options including Trustor Protector, Special Needs Trust, or Special Powers of Attorney

| Flat-Rate: $3500

Estate Planning Resources

Updating Your Estate Plan: When and Why You Should Review Your Documents

Ensure your estate plan keeps pace with life's changes. Discover when and why you should review and update your estate plan.

Read More

Estate Planning for Small Business Owners: Protecting Your Business and Your Family

Protect your small business and your family's future with effective estate planning. Learn about business succession, buy-sell agreements, life insurance, business valuation, and trust strategies.

Read MoreJustin Walley, Estate Planning Attorney Interview on ThisDay

Our very own estate planning attorney, Justin Walley, was recently featured on ThisDay with Bobbi Higgins where he shared some invaluable insights on estate planning.

Watch Video on YouTube

How to Minimize Estate Taxes and Maximize Inheritances

Explore effective strategies to reduce estate taxes and ensure your loved ones receive the maximum inheritance. Discover how annual gifts, trusts, and expert estate planning can help secure your family's financial future.

Read More

Planning for Long-Term Care: Medicaid and Medi-Cal Eligibility

Learn about planning for long-term care and the eligibility requirements for Medicaid and Medi-Cal. LS Carlson Law can help you understand the complexities and explore options for securing your future needs.

Read More

The Benefits of a Living Trust: Why You Should Consider One

Estate planning for blended families can be challenging. Learn valuable tips for navigating the complexities of estate planning in blended families.

Read More

Estate Planning for Blended Families: Navigating Complex Family Structures

Estate planning for blended families can be challenging. Learn valuable tips for navigating the complexities of estate planning in blended families.

Read More

How to Choose the Right Executor for Your Estate

Selecting the right executor for your estate is vital for a smooth administration process. Learn what factors to consider and how our estate planning attorneys can guide you in making this important decision.

Read More

The Importance of a Will and How to Draft One That Fits Your Needs

Discover the significance of having a will and learn how to draft one that aligns with your wishes.

Read More

How to Protect Your Assets and Provide for Your Children with a Trust

Learn how to safeguard your assets and secure your children's future with a trust.

Read More

5 Essential Documents for Estate Planning in California

Ensure your loved ones are taken care of and your assets are protected with these 5 essential documents for estate planning in California.

Read MoreA Professional Strike Force for Your Legal Matters

LS Carlson Law is comprised of battle-tested, highly skilled lawyers who operate with a single objective – to win. We prioritize efficiency and innovative strategies, and in doing so, have waged war on the “old way of doing things.”

Partner

Partner

Partner

Partner

Partner

Partner

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Associate Attorney

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Paralegal

Accounts Receivable

File Clerk

Administrative Assistant

Senior Paralegal

Accounts Receivable Assistant

Administrative Assistant

Client Services Specialist

Client Services Specialist

Director of Administration

Client Services Specialist

Paralegal/Administrative Assistant

Administrative Assistant

Client Activation Coordinator/Administrative Assistant

Legal Assistant

Administration Assistant

Director of Client Services

Paralegal

Director of Billing Services

Client Services Specialist

Legal Assistant

Client Activation Coordinator/Assistant Case Manager

Accounts Receivable

Tell Us About Your Estate Planning Needs

When you hire LS Carlson Law, you can be assured you’ll be getting a firm fully dedicated to achieving your estate planning objectives. Don’t take our word for it, we encourage you to take a look at the numerous five-star client reviews. If you are ready to get started with a plan tailored to your exact needs and situation, call us or fill out the form to set an appointment.