AS FEATURED IN:

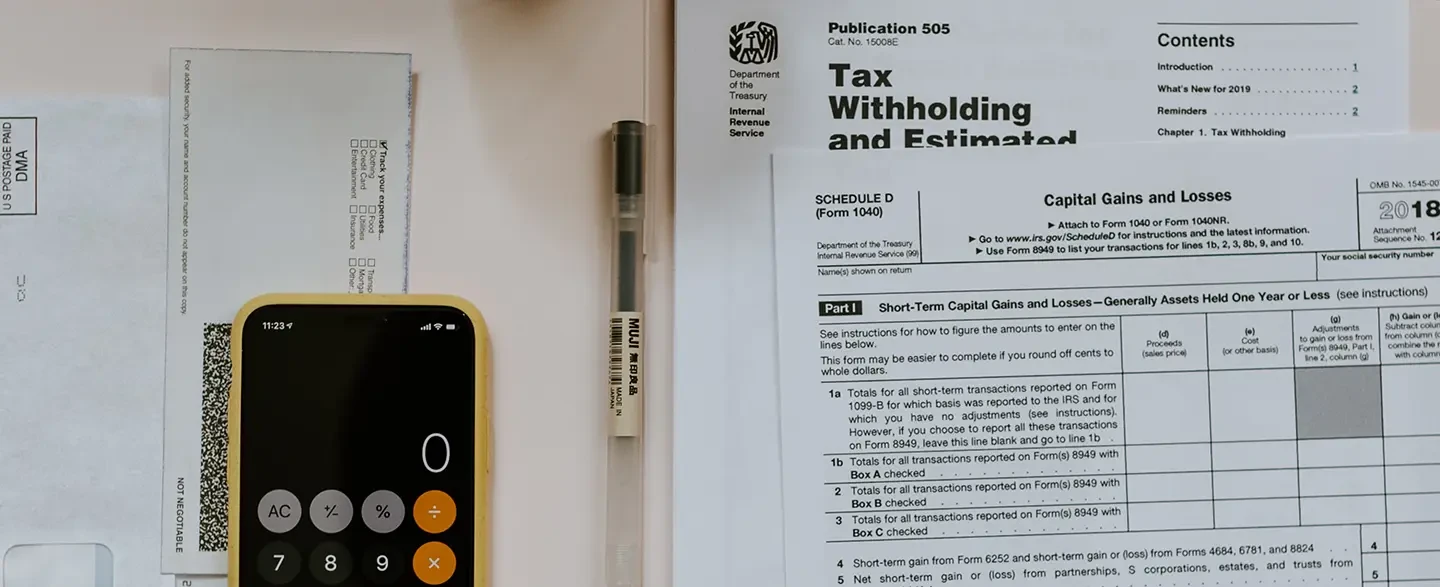

Years of Tax Credit Experience: We Know How to Defend an Audit

At LS Carlson Law, we understand the challenges businesses face when navigating relief programs and tax credits such as the Employee Retention Credit (ERC) or the Paycheck Protection Program (PPP). Our team of experienced attorneys is here to provide dedicated support and protection during audit proceedings related to these programs. We stay up-to-date with the latest regulations and guidelines to ensure your business is in compliance and that you maximize the benefits available to you. Whether you need assistance with documentation, responding to audit inquiries, or negotiating with tax authorities, our attorneys have the experience to handle these complex matters effectively. We work tirelessly to protect your rights, mitigate your exposure to liabilities, and help you achieve the most favorable outcome possible. Trust LS Carlson Law to provide strategic guidance and unwavering advocacy for your business's relief program and tax credit audit needs, allowing you to focus on what you do best—running your business.

Comprehensive PPP audit support for businesses seeking assistance in navigating the complexities of the Paycheck Protection Program. Our team of experienced tax law professionals is well-versed in the intricacies of PPP regulations and has a proven track record of successfully guiding clients through the audit process. Whether your business is facing a PPP loan review or an audit, our dedicated experts will work tirelessly to ensure your compliance with all relevant guidelines. With our in-depth understanding of tax laws and extensive experience in handling PPP audits, you can trust us to provide the expertise and support needed to safeguard your business interests during this critical phase.

At LS Carlson Law, we have had years of expertise in assisting clients with the Employee Retention Credit (ERC) and understand the complexities of this tax incentive inside-out. Our ERC audit support services are tailored to address the unique needs of your business, offering comprehensive guidance and representation throughout the audit process. Having helped numerous clients successfully file for ERC, we possess an in-depth understanding of the law, enabling us to skillfully advocate for your business during any audit proceedings. Rest assured that our team of dedicated tax law professionals will leverage their extensive knowledge and experience to ensure that your ERC claims are accurately documented, substantiated, and compliant with all applicable regulations. Confidently navigate ERC audits, knowing that your business's interests are safeguarded by experts who truly understand the intricacies of the law.

Frequently Asked Questions

Yes. If you cannot afford to pay the IRS the full amount of your tax liability you have options. First, you can enter into a payment plan or installment agreement and pay your liability, over time for up to 72 months. You may also be able to reduce your tax debt by submitting an Offer in Compromise (OIC). For taxpayers, individuals or businesses, with little to no assets, an OIC can reduce your tax debt and help you pay a lesser amount over a short period of time. We can assist in determining whether an OIC may be right for you, prepare the OIC application and gather the necessary documents, as well as directly negotiate with the IRS to get your tax liability reduced from as much as possible.

Audits of your tax return can be a very long, frustrating, and stressful process whether it concerns income tax, payroll tax, or sales tax. In general, you will need to respond to an IRS audit notice within 30 days. Unfortunately, many taxpayers make the mistake of responding late or inadequately causing a prolonged audit, exposing themselves to additional tax liability or even opening themselves up to additional audits. For these reasons, it is important that you speak with an experienced tax attorney familiar with the audit process. At LS Carlson Law, we are equipped to represent you before federal or state tax authorities throughout your entire audit process – from the initial notice of audit to appealing your audit findings.

It is likely that the IRS will audit suspicious claims due to the mills promoting the ERC and filing ERC claims regardless of eligibility. The IRS has responded by issuing Notice IR-2022-183 warning taxpayers to avoid seeking advice from companies that do not have legal tax knowledge or experience. The IRS has also extended the general 3-year statute of limitations to audit a tax return to a 5-year statute of limitations for certain ERC claims. To that end, we recommend that you consult with a qualified tax attorney to determine your eligibility and prepare your ERC claim.

If you received notice about your PPP Forgiveness application, we recommend you speak with a professional with experience applying for and auditing PPP Forgiveness applications in order to assess the accurate wages paid and qualified expenses eligible for forgiveness. Based on the accuracy of your PPP Forgiveness amounts, you may need to provide additional documentation in support of your initial application or submit amended forgiveness applications with corrected amounts.

Even if your business gross receipts increased overall during the pandemic, you may still qualify for the ERC. Since the ERC is a quarterly payroll tax credit, the analysis is conducted on a quarterly basis, not annual. You may have experienced a significant decline in gross receipts in one quarter in 2020 or 2021 compared to the same quarter in 2019 even if your overall yearly income increased. If you did not experience a significant decline in gross receipts, you may still be eligible if you experience partial or full suspension of operations. Whether a government mandate required you to suspend your operations requires a detailed analysis of your business and the impact of Covid-19 restrictions. As part of our service, we provide you with our findings on your eligibility and calculate your ERC credit amount to maximize your refund amount (IRS Notice 2021-20 and IRS Notice 2021-23).

You may still be eligible for the ERC even if you received PPP loan forgiveness. You cannot claim the ERC for wages that were used to apply for PPP forgiveness. This means no double dipping. However, you may be eligible to receive the ERC for wages paid outside the PPP covered period or wages in excess of the PPP forgiveness amount by employee. Due to the potential for inadvertent ERC claims for wages that are not eligible, we recommend that you speak with a tax attorney knowledgeable with the PPP loan process and ERC claims to avoid incurring tax penalties and interest (IRS Notice 2021-20 and IRS Notice 2021-49).

Generally, for most taxpayers, 2020 ERC claims are due by April 15, 2024, and 2021 claims are due by April 15, 2025. However, it is best for you to file any eligible claims as soon as possible since there is no guarantee that that the IRS will continue to accept these claims until those dates.

Our US headquarters is located in Aliso Viejo, California. For those who live outside the practical travel proximity to our office, we understand you may have concerns about the distance between our law office and your home. However, we want to assure you that this should not be a concern when considering our firm to represent you in your tax credit audit. We have successfully represented hundreds of clients throughout the country and have proven procedures in place to ensure the process is smooth and painless regardless of where you live. First, much of the communication and document exchange between our firm and clients can be done electronically, making distance less of an issue. We have a secure client portal where you can access all the important documents and communicate with us, so you won't have to worry about travel. Second, the legal process of resolving tax credit audits often involves a significant amount of research and document review, which can be done remotely. Our firm has the resources and expertise necessary to effectively represent clients regardless of their location. Finally, it's important to remember that what matters most in a legal dispute is the quality of representation, not the proximity of the law office. LS Carlson Law has extensive experience in tax credit law and has a proven track record of success. We have the knowledge and skills to effectively advocate for your rights and interests, regardless of where our office is located. In summary, while the location of our law office may be a concern for some, it should not be a deciding factor when considering LS Carlson Law to represent you for your tax credit audit. Our firm has the resources and expertise to effectively represent clients remotely, and what's most important is the quality of representation. Rest assured that we will do everything in our power to ensure that you receive the best possible outcome in your audit.

A Professional Strike Force for Your Tax Matters

LS Carlson Law is comprised of battle-tested, highly skilled lawyers who operate with a single objective – to win. We prioritize efficiency and innovative strategies, and in doing so, have waged war on the “old way of doing things.”

Partner

Partner

Partner

Partner

Partner

Partner

Partner

Partner

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Associate Attorney

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Paralegal

Accounts Receivable

File Clerk

Administrative Assistant

Senior Paralegal

Accounts Receivable Assistant

Administrative Assistant

Client Services Specialist

Client Services Specialist

Director of Administration

Client Services Specialist

Paralegal/Administrative Assistant

Administrative Assistant

Talent & Culture Coordinator

Legal Assistant

Administration Assistant

Director of Client Services

Paralegal

Director of Billing Services

Client Services Specialist

Legal Assistant

Client Activation Coordinator/Assistant Case Manager

Accounts Receivable

Tell Us About Your Tax Needs

When you hire LS Carlson Law, you can be assured you’ll be getting an aggressive firm fully dedicated to achieving your legal objectives. Don’t take our word for it, we encourage you to take a look at the numerous five-star client reviews. If you are ready to end the nightmare, call us or fill out the form to set an appointment.