AS FEATURED IN:

An Overview from a Tax Attorney

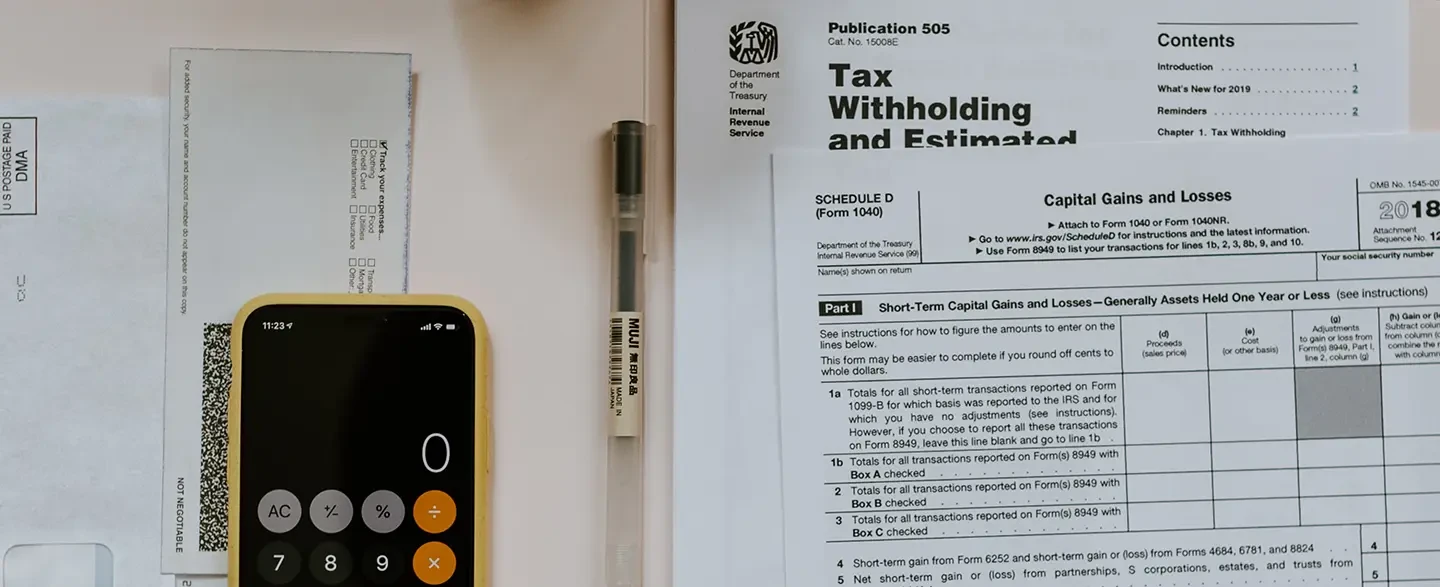

The Research and Development (“R&D”) tax credit was created to incentivize and encourage companies to improve and discover new products or processes in the course of their business. Its goal is to reward innovation and accomplishment. However, many eligible businesses miss out on this valuable credit because of the various misconceptions surrounding the credit. So, are you eligible?

How Does The Credit Work?

This federal tax credit reduces your income tax liability by your qualifying research expenses. These expenses generally include research related costs for supplies and wages. Typically, the income reduction will be dollar-for-dollar for expenses up to 10% of the total qualifying expenses.

In the alternative, qualified small businesses can even apply up to $500,000 of their R&D credit against payroll taxes. This payroll tax option can be especially useful for start-up companies that may have a lower income tax liability.

You can also carry forward the credit 20 years.

Industries That Can Benefit From This Credit

At inception, the R&D credit was limited to a narrow group of technological businesses. However, the credit has developed and can now be claimed by a wide array of businesses. Below are examples of industries that often qualify for the credit:

Why Work With An Attorney?

Your eligibility for the R&D credit is a question of law. Legal acumen is necessary to decipher and interpret the various tax codes and regulations associated with the research and development laws. Our team of experienced attorneys is experienced at maneuvering through the legal intricacies to help you successfully claim this credit. Contact us today and let us help you make the most of the R&D credit for your business.

In the aerospace industry, there are various potential expenses that could qualify for the R&D tax credit. These include activities such as computer-aided design (CAD), modeling, and finite element analysis (FEA) simulation for aerospace product development, the creation and testing of prototypes, designing innovative aerospace concepts to enhance performance and reliability, optimization of manufacturing processes specific to aerospace products, and conducting tests on aerospace components to ensure they comply with regulatory standards and safety requirements.

In the agriculture sector, there exist several potential expenses that might qualify for the R&D tax credit. These encompass precision farming techniques aimed at boosting crop yields, endeavors related to flavor development and ingredient formulations for food products, the evaluation and experimentation with new feeds and feeding techniques to enhance livestock production, enhancements to manufacturing processes, the creation of new or improved packaging solutions, as well as the development and testing of new products geared towards improving food quality to meet specific requirements.

Within the realm of architecture and engineering, there are numerous potential expenses that may qualify for the R&D tax credit. These encompass activities such as designing building facades and floor plans, devising energy-efficient designs tailored to specific buildings, the implementation of water distribution systems for municipalities and water districts, designing electrical insulation, HVAC, or structural systems, evaluating alternative heating and cooling methods, innovating space utilization, and enhancing designs to align with functional requirements.

In the automotive industry, there are various potential expenses that could qualify for the R&D tax credit. These include activities like the design of manufacturing equipment, enhancing manufacturing efficiency, conducting tests on alternative materials, designing, developing, and improving automotive components, creating and testing product prototypes, making new part designs or revisions to enhance product performance, ensuring compliance with regulations and safety requirements through testing, initiatives to improve environmental and worker safety, the development of new or improved tooling and equipment, prototyping and three-dimensional modeling, as well as efforts aimed at incorporating environmental considerations into overall operations.

In the brewery industry, there are numerous potential expenses that may qualify for the R&D tax credit. These include activities such as the development of new or improved product formulations, the creation of craft brewing or bottling equipment, the advancement of keg-filling or treatment techniques, product design testing to ensure shelf life, the enhancement of ingredient processing techniques, the improvement of filtration methods, the development of ingredient-mixing methodologies, the creation of new or improved preservative chemicals, the testing of product ingredient mixtures for desired flavors, the innovation of processes for bottling or canning, the establishment of new or improved water recycling procedures, the development of yeast strains or fermentation processes, and the exploration of hopping techniques or hop varieties.

In the field of chemical development, various expenses have the potential to qualify for the R&D tax credit. These include activities such as the creation and testing of new formulations and products, experimentation with new additives or stabilizers to enhance product quality, the refinement of existing procedures to meet necessary regulations, certifications, and standards, the design and implementation of new equipment to enhance manufacturing processes, the innovation of 3D printing technology using novel materials or compounds, the testing and implementation of environmentally-friendly manufacturing methods, as well as the assessment of applications for new chemical compounds.

In the realm of metal casting, there are several examples of qualified research expenses that could potentially be eligible for the R&D tax credit. These include activities like designing for tight tolerances that are new to the company, designing for use in harsh climates, enhancements to the metal casting process encompassing aspects such as melting, coating, heat treatment casting, molding, welding techniques, pollution control, waste and furnace charging systems, and the development of new gating and riser designs, with an emphasis on reducing or recycling excess coating. Additionally, qualifying expenses may also relate to new product development, focusing on improving attributes like strength, stress tolerances, durability, or service life, as well as the exploration of new technologies pertaining to filtration processes, pouring techniques, temperature control and measurement, monitoring metallurgical process performance, flow control, mold and coating materials, and binder materials.

In the healthcare sector, various types of expenses have the potential to qualify for the R&D tax credit. These include the development of software applications for telemedicine or virtual visits, software applications aimed at enhancing the delivery of healthcare management services, the creation of algorithms designed to improve fundamental computer processes like sorting, searching, or compressing healthcare data, the development of electronic medical record software solutions, and the design of software capable of staying compliant with evolving HIPAA regulations and industry standards. Additionally, eligible expenses may also relate to blockchain applications for healthcare, the creation of devices for monitoring, collecting, analyzing, and transmitting healthcare data, the development of patient-engagement tools, payer/provider analytics and data tools, as well as the application of artificial intelligence in various healthcare-related tasks, including nursing-related and administrative functions.

In the machining industry, there are various potential expenses that could qualify for the R&D tax credit. These include activities such as coding and programming for machinery communication, employing computer-aided design (CAD) and computer-aided manufacturing (CAM) for modeling and simulation, computer numerically controlled (CNC) programming, designing for tight tolerances, developing prototype tooling, and the creation of robotics and automated technology. Qualifying expenses may also involve efforts to eliminate or minimize warpage in welding and fabrication processes, experimentation with different materials, maintaining milling process speed without breakage, ensuring uniform constraints in the lathing process, maximizing feeds and speeds while maintaining part quality and integrity, engaging in modeling, simulation, or systematic trial and error, and addressing special fixture requirements.

Within the manufacturing industry, numerous expenses may potentially qualify for the R&D tax credit. These encompass activities such as the design and development of custom tooling and fixtures, the creation of prototypes tailored to various customer specifications and requirements, the transformation of manual processes into automated ones through software development, and the design, construction, and testing of first article prototypes. Additionally, eligible expenses may relate to custom fabrication to meet specific customer needs, the development of new or enhanced processes aimed at increasing yield or overall performance, improvements to quality assurance processes to enhance product reliability, the creation of new or enhanced processes or products to adhere to federal or state regulatory requirements, and the exploration of novel techniques to boost the performance of a product or process.

In the realm of software development, there exist numerous potential expenses that might qualify for the R&D tax credit. These include activities such as programming software source code, designing and developing the structural software architecture, establishing electronic interfaces and functional relationships between various software modules, conducting various forms of analysis including requirements, domain, software elements, or scope analysis for new functional software enhancements, evaluating and establishing functional specifications, conducting various testing phases such as unit, integration, functional, performance, and regression testing, as well as compiling and testing source code. Additionally, qualifying expenses may also pertain to the development of new or improved technologies within the software development process.

In the field of tool and die manufacturing, a range of expenses may potentially qualify for the R&D tax credit. These include activities such as designing new tools, dies, casts, jigs, and fixtures, experimentation aimed at developing production processes, the creation of strip layouts during feasibility and quoting stages, and the development of 3D models coupled with experimentation through simulation. Additionally, qualifying expenses may involve improvements in material usage achieved by modifying production processes, the optimization of geometry to minimize tooling complexity, the development of software models for analyzing material movement during forming, the creation of prototypes and first articles for validation purposes, die construction and tool tryout activities, the development of programs for automated production equipment, including CNC programming, validation testing to determine the final design of tooling, experimentation to ascertain the repeatability and quality of production processes, and the production of prototypes and low-rate initial production for testing and validation purposes.

The Winery & Vineyard Industry holds untapped potential for substantial research credits, providing annual cash savings for product and process enhancements. These credits can significantly benefit businesses by facilitating hiring, boosting R&D, and expanding production capabilities. Explore the uncharted potential of R&D credits in the Winery & Vineyard Industry with our assistance, offsetting AMT liability for eligible small businesses and using up to $250,000 against payroll taxes for qualified start-ups.

Frequently Asked Questions

To determine if an expense qualifies for the R&D tax credit, it must undergo scrutiny based on four essential criteria. Firstly, the expenditure should be linked to the resolution of uncertainties related to product development. Secondly, it should pertain to the acquisition of technical information. Thirdly, the cost must be incurred in an endeavor to explore and enhance a new or improved business component, which encompasses products, processes, computer software, techniques, formulas, or inventions employed within the taxpayer's business. Finally, the taxpayer must not only identify the specific uncertainties they are researching but also outline one or more approaches aimed at resolving these uncertainties, subsequently engaging in a thorough evaluation process of these alternatives.

The R&D program excludes several types of expenses from qualification. These non-qualifying expenses encompass various activities and costs, such as research conducted outside the U.S., consumer preference testing, administration, training, repairs and maintenance, tooling-up for production, trial production runs, trouble shooting, accumulating data relating to production processes, research after commercialization, activities relying on the social sciences/arts/humanities, preproduction planning for a finished component, adapting existing components to a particular customer's need, duplicating an existing component via reverse engineering, and routine data collection or ordinary testing for quality control of existing components.

Businesses that find themselves with unused R&D credits still have opportunities to leverage these valuable incentives. If a company failed to claim the credit in previous tax years, it can file amended tax returns for those years to rectify the oversight.

Once the credit is properly claimed, businesses can carry forward any remaining unused credits for up to 20 years after the initial carryback year. This carryforward provision ensures that companies utilize the full benefits of the R&D credit, allowing for continued investments in research and development activities.

Yes, research expenses for the taxable year must be reduced by the amount of the R&D credit claimed in the taxable year, which will result in an increase in taxable income. However, the resulting increase in tax is reduced by the credit amount.

A Professional Strike Force for Your Tax Matters

LS Carlson Law is comprised of battle-tested, highly skilled lawyers who operate with a single objective – to win. We prioritize efficiency and innovative strategies, and in doing so, have waged war on the “old way of doing things.”

Partner

Partner

Partner

Partner

Partner

Partner

Partner

Partner

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Associate Attorney

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Paralegal

Accounts Receivable

File Clerk

Administrative Assistant

Senior Paralegal

Accounts Receivable Assistant

Administrative Assistant

Client Services Specialist

Client Services Specialist

Director of Administration

Client Services Specialist

Paralegal/Administrative Assistant

Administrative Assistant

Talent & Culture Coordinator

Legal Assistant

Administration Assistant

Director of Client Services

Paralegal

Director of Billing Services

Client Services Specialist

Legal Assistant

Client Activation Coordinator/Assistant Case Manager

Accounts Receivable

Tell Us About Your Tax Needs

When you hire LS Carlson Law, you can be assured you’ll be getting an aggressive firm fully dedicated to achieving your legal objectives. Don’t take our word for it, we encourage you to take a look at the numerous five-star client reviews. If you are ready to end the nightmare, call us or fill out the form to set an appointment.