AS FEATURED IN:

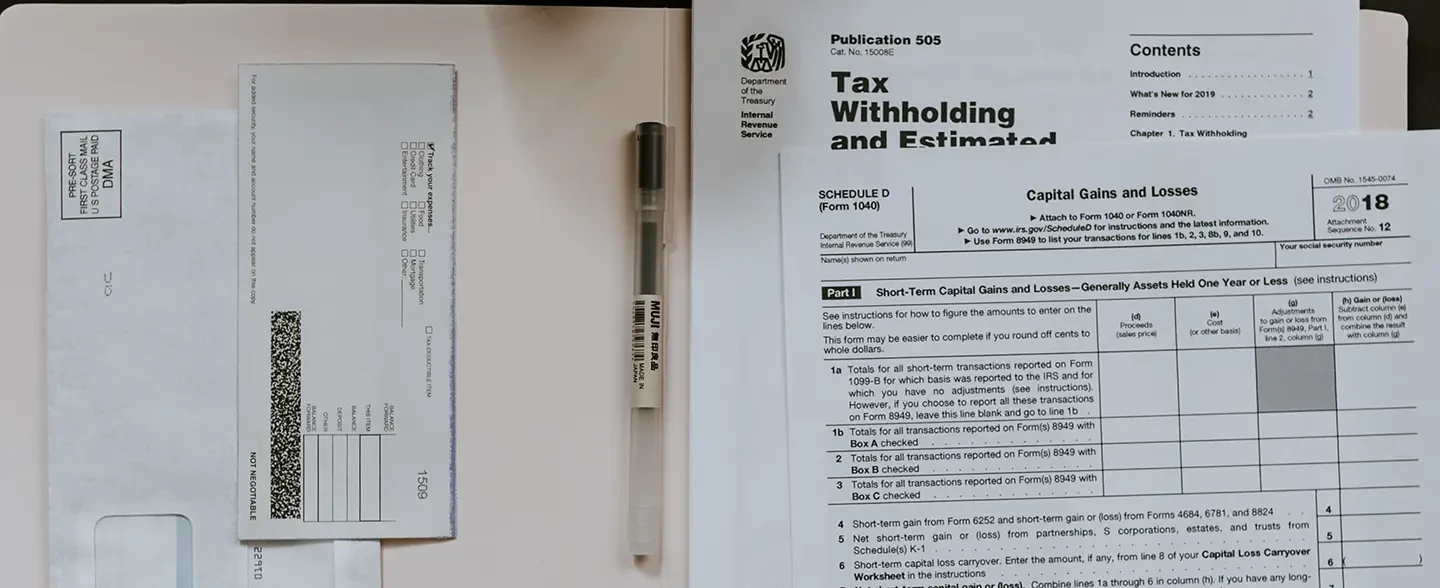

A Rare Opportunity from the IRS to Rethink Your ERC Claim

Understanding the Implications of IRS's Recent Updates on ERC Claims

As millions of reputable businesses continue to fall victim to the questionable practices of Employee Retention Credit (“ERC”) promoting companies, it is extremely important that employers understand the initiatives the IRS has taken to penalize ERC abuse.

Initiative 1: The IRS imposed a moratorium on new claims that will remain in effect until at least January 2024.

When the IRS announced its ERC moratorium on September 14, 2023, it also announced a revised and stricter standard of review for all claims. Whether you already received your refund, you’re concerned about your eligibility, or you want to find out if you’re eligible for the ERC, it is highly recommended that you work with a trusted and experienced tax professional who can carefully assess your compliance and meticulous substantiate your eligibility – especially given that the IRS has referred thousands of these claims to audit and hundreds are currently undergoing criminal investigation.

Initiative 2: The IRS is permitting taxpayers to withdraw unprocessed claims.

If your ERC claim has not yet been filed but not yet processed, the IRS is extending a withdrawal option to help taxpayers unaware their ineligibility to avoid receiving an erroneous refund only to pay it all back including penalties and interests.

Initiative 3: The IRS has introduced a voluntary disclosure program allowing taxpayers to rectify processed ineligible claims.

If your claim has already been processed and you received your refund, certain eligible employers have until March 22, 2024, to take advantage of this rare opportunity to correct their ineligible claims. Below is a brief summary of the program’s benefits:

· Taxpayers only need to repay 80% of the credit received;

· The 20% reduction is not taxable as income;

· No need to repay the credit’s interest; and

· Taxpayers will not be required to amend their income tax returns to reduce wage expenses.

LS Carlson Law: Ensuring Compliance and Peace of Mind

The accuracy of an ERC claim is ultimately the responsibility of the business owner, regardless of who prepared it. To avoid potential IRS issues, it is critical that your ERC claim is accurate, substantiated, and compliant with current tax laws.

Our team of tax attorneys have prepared many complex ERC claims, reviewed many unsubstantiated ERC claims by promoters, and even worked as advisors for tax firms offering ERC services. As such, the firm is especially equipped to address complex compliance issue with the IRS. We are prepared to assist you in navigating the uncertainties surrounding the ERC. Our comprehensive reviews and advice is the first step to giving an accurate depiction of your eligibility and exposure to IRS enforcement and liabilities. Contact us for a consultation to protect and defend your business's financial standing.

Frequently Asked Questions

The ERC is a tax credit introduced as part of the COVID-19 relief efforts to encourage businesses to keep employees on their payroll. It offers qualifying employers a credit against employment taxes for wages paid to employees during the pandemic.

Our team of tax attorneys can conduct a thorough review of your ERC application to ensure accuracy and compliance with IRS guidelines. We also assist with preparing and submitting applications, making necessary adjustments, and providing guidance on complex tax issues related to the ERC.

Contact us immediately. Our attorneys can review your previously filed claims, identify any potential issues, and advise on the best course of action, which may include amending the application or exploring the IRS’s voluntary withdrawal or disclosure options.

Absolutely. Regardless of who originally filed your ERC claim, our attorneys can review it to confirm compliance and accuracy. If we find issues, we can assist in rectifying them, potentially reducing the risk of penalties or an audit.

Filing an inaccurate ERC claim can lead to serious consequences, including audits, penalties, interest, and the requirement to repay the credit amount. Professional review helps ensure that your application is compliant with IRS regulations, minimizing these risks.

The timeline can vary depending on the complexity of your claim and the extent of the required adjustments. Our team works efficiently to review and address any issues promptly, and we will provide a more specific timeline once we assess your individual case.

The deadline to apply for the voluntary disclosure program is March 22, 2024. LS Carlson Law can assist in preparing and submitting your application documents to ensure it meets all necessary criteria.

Determining your eligibility for the ERC depends on various factors. The IRS provides an ERC Eligibility Checklist tool on their website, which can be a helpful starting point. For a more personalized assessment, we recommend consulting with one of our tax attorneys. Our team can provide legal guidance tailored to your specific business situation, ensuring you make informed decisions regarding your ERC application.

You are generally expected to repay the ERC amount received, minus a 20% reduction. What this means is that if you received a $100,000 refund, your repayment would typically be $80,000. However, each case is unique. At LS Carlson Law, we have experienced instances where our review validated the claimed amount or even identified opportunities for additional legitimate claims. Our team can provide a detailed analysis of your case, ensuring that your financial obligations under the disclosure program are accurately determined depending on the nuances of your situation.

If your business claimed and received the ERC but was not entitled to it, and you opt out of the ERC-VDP, you may be detected by the IRS. This could result in forfeiture, substantial interest charges, penalties, and an increased risk of criminal investigation and prosecution.

ERC Resources

LS Carlson Law Featured in Daily Journal: "Maximizing Employee Retention Credit for Businesses"

Discover LS Carlson Law's feature in the Daily Journal, offering vital insights into the Employee Retention Credit (ERC). Learn about eligibility, criteria, and tax implications.

Read More

LS Carlson Law Featured In Inc. Magazine

The Employee Retention Credit Is a Great Deal--but Beware 'ERC Mills'

Visit WebsiteA Professional Strike Force for Your Tax Needs

LS Carlson Law is comprised of battle-tested, highly skilled lawyers who operate with a single objective – to win. We prioritize efficiency and innovative strategies, and in doing so, have waged war on the “old way of doing things.”

Partner

Partner

Partner

Partner

Partner

Partner

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Paralegal

Accounts Receivable

File Clerk

Administrative Assistant

Senior Paralegal

Accounts Receivable Assistant

Administrative Assistant

Client Services Specialist

Client Services Specialist

Administrative Assistant

Director of Administration

Client Services Specialist

Paralegal/Administrative Assistant

Administrative Assistant

Client Activation Coordinator/Administrative Assistant

Legal Assistant

Director of Client Services

Paralegal

Director of Billing Services

Client Services Specialist

Legal Assistant

Client Activation Coordinator/Assistant Case Manager

Accounts Receivable

Tell Us About Your Business

When you hire LS Carlson Law, you can be assured you’ll be getting an aggressive firm fully dedicated to achieving your legal objectives. Don’t take our word for it, we encourage you to take a look at the numerous five-star client reviews. If you are ready to end the nightmare with your homeowner association, call us now or fill out the form to set an appointment.