AS FEATURED IN:

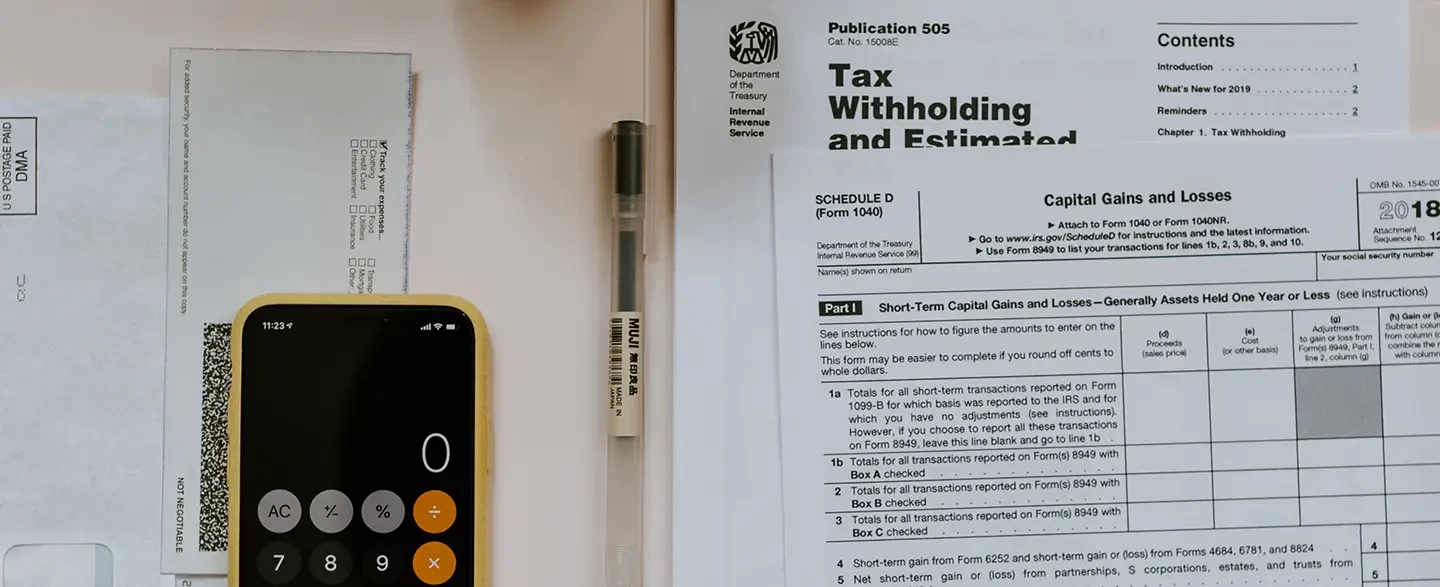

Save Energy & Money By Claiming The 179D Tax Deduction

The Energy Efficient Commercial Building 179D Tax Deduction, also known as the “Green Building Tax Deduction” allows businesses to deduct the full purchase price of qualifying expenses during the current tax year.

What’s The Tax Advantage?

As you may already know, the purchase cost of certain business equipment must be depreciated over a period time instead of expensing the cost in the year it was incurred. For example, if you bought a truck for $75k, you’re required to write off $15k a year for 5 years. The 179D deduction allows your business to immediately deduct the $75k in the current year, which could help lower your current tax bill.

How Does The Deduction Work?

In order to claim the 179D deduction, expenses incurred to reduce the energy consumption in a commercial building are deductible if they meet a certain standard. The deducibility of such expenses should be substantiated by a connection between the improvement and the expense. Although the calculation of the deductible expense is technical by nature, it generally involves a base amount that is calculated by the level of the improvement’s energy efficiency in combination with the square footage of the building. If all criteria are met, you may be eligible to claim a deduction up to $1.00 per square foot.

You may also qualify for an increased bonus rate of up to $5.00 per square foot if the contractors and laborers working on the project also meet certain requirements. This means that if the improved building is 20,000 square feet, you could be eligible for up to $100,000 in deductible expenses.

This could include the installation of more efficient HVAC systems or the addition of insulation to improve the building’s overall energy efficiency. To qualify for the deduction, these improvements must result in at least a 25% reduction in total annual energy/power costs.

LED lighting is much more efficient than traditional incandescent and fluorescent bulbs, and upgrading to LED lighting can result in significant energy savings. The installation of other energy-efficient lighting solutions may also qualify for the deduction.

Energy-efficient alternatives for water systems can include solar-powered pumps, efficient water heaters, and other upgrades to reduce water consumption and waste.

Improvements to certain roofing systems, solar integration, daylighting, walls, floors, roofs, fenestrations, and doors.

Frequently Asked Questions

The 179D Tax Deduction is generally accessible to commercial building operators and owners, owners of residential buildings with four or more stories, as well as designers of buildings owned by nontaxable entities like government and non-profit organizations. To make the most of these significant tax savings, it's advisable to leverage the expertise of LS Carlson Law, who can assist you in navigating the complexities of the 179D Tax Deduction and ensuring you maximize your benefits.

Your business may qualify for a bonus deductible rate if the contractors and laborers involved in the project meet specific requirements, known as the prevailing wage and apprenticeship requirements. To satisfy the prevailing wage requirement, those involved in the energy-efficient improvement project must have been paid wages that are at least equal to the prevailing rates for construction, alteration, or repair of a similar nature in the local area of the building. Additionally, to meet the apprenticeship requirement, a certain percentage of the total labor hours required for the energy-efficient improvement should have been carried out by qualified apprentices. The applicable percentages vary based on the construction start date, with 10% applying to construction starting before January 1, 2023, 12.5% for construction beginning after December 31, 2022, and before January 1, 2024, and 15% for construction commencing after December 31, 2023.

To be eligible for the deduction, the energy-efficient commercial building improvement must be incurred as part of a plan designed to reduce the total annual energy and power costs by 25% (50% or more to maximize the deduction). This standard is determined by the American Society of Heating, Refrigeration, and Air Conditioning Engineers (ASHRAE).

Before claiming the IRC 179D deduction, the taxpayer must obtain a Certification from a “Qualified Individual”. The Certification must verify that the energy efficient commercial building property improvement meets the applicable Reference Standard 90.1. A “Qualified Individual” is an individual not related to the taxpayer who is an engineer or contractor licensed in the state in which the building is located.

The 179D deduction can only be claimed for improvements to commercial property. However, if you made qualified energy-efficient improvements to your home, you may qualify for a tax credit up to $3,200.00 by claiming the Energy Efficient Home Improvement Credit.

A Professional Strike Force for Your Tax Matters

LS Carlson Law is comprised of battle-tested, highly skilled lawyers who operate with a single objective – to win. We prioritize efficiency and innovative strategies, and in doing so, have waged war on the “old way of doing things.”

Partner

Partner

Partner

Partner

Partner

Partner

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Senior Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Associate

Administrative Assistant

Paralegal

Accounts Receivable

File Clerk

Administrative Assistant

Senior Paralegal

Accounts Receivable Assistant

Administrative Assistant

Client Services Specialist

Director of Administration

Client Services Specialist

Paralegal/Administrative Assistant

Administrative Assistant

Client Activation Coordinator/Administrative Assistant

Legal Assistant

Director of Client Services

Paralegal

Director of Billing Services

Client Services Specialist

Legal Assistant

Client Activation Coordinator/Assistant Case Manager

Accounts Receivable

Tell Us About Your Tax Needs

When you hire LS Carlson Law, you can be assured you’ll be getting an aggressive firm fully dedicated to achieving your legal objectives. Don’t take our word for it, we encourage you to take a look at the numerous five-star client reviews. If you are ready to end the nightmare, call us or fill out the form to set an appointment.

(949) 421-3030

(949) 421-3030